Payday Lending Roundtable Forum

Alabama lenders are allowed to charge 456% APR. That is a problem.

Tuesday, Feb 19 | 7:00 – 8:00 p.m.

Payday Lending Roundtable Forum

The huge amounts of political contributions given by the payday industry to many Alabama legislators are a major factor of concern. Learn MoreAbout Alabama’s Predatory Lending problem

Out of state companies benefit:

The huge profits paid to high-cost lenders don’t stay in Alabama. These out-of-state businesses take money from vulnerable Alabama borrowers and distribute it to companies in other states.

In 2015 alone, these companies made more than $117 million off the backs of Alabamians.

They drain local economies by creating cycles of debt, and reducing consumer spending in communities across the state.

HURTING LOCAL BUSINESSES:

Every $1 spent paying back a high-cost lender takes almost $2 out of the local economy due to depleted consumer finances and increased bankruptcies.

Storefronts of payday and title pawn lenders cause blight in neighborhoods, making it difficult for municipalities to attract other businesses.

The average rate for predatory loans is 300% but can go up to 456%.

PRO-FAMILY ISSUE:

Exploiting the poor through predatory lending practices was wrong in Biblical times and it remains wrong in Alabama communities today.

The effects of predatory lending rob individuals and families of the opportunity for economic viability.

Many believe there may be a role for payday lending companies, but there is no justification for charging the exorbitant interest rates that are currently provided.

The huge amounts of political contributions given by the payday industry to many Alabama legislators are a major factor of concern.

Alabama borrowers deserve better than short-term loans they cannot afford.

WHAT CAN BE DONE:

Alabama has more payday lenders than any other state per capita.

We must push for more guiding principles for payday lenders and lesser interest rates for borrowers.

Close to 20 states and the United States Military have protected themselves from this industry by outlawing it.

Without payday lenders, people in need of money would still have access of up to $1,000 under Alabama’s Small Loan Act. There are options out there for people who need loans.

End the predatory cycle

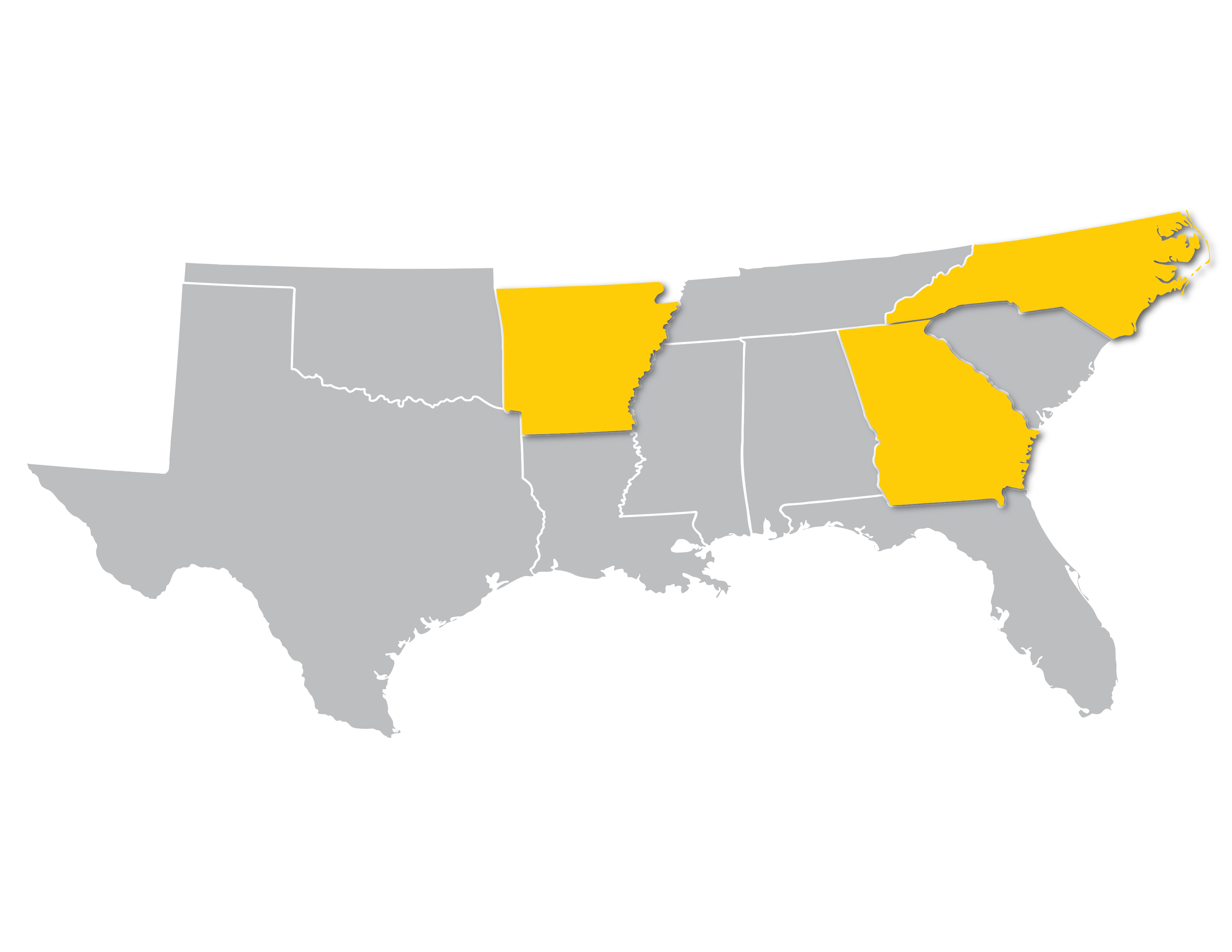

These southern states have passed laws to end the predatory cycle.

Alabama must do the same!

Major Payday / Predatory Lenders

- Community Choice Financial – Dublin, OH

- Enova International – Chicago, IL

- Advance America – Spartanburg, SC

- Approved Cash Advance – Cleveland, TN

- Check into Cash – Cleveland, TN

- Check ‘n Go – Cincinnati, OH

- Speedy Cash – Wichita, KS

**TitleMax – Savannah, GA

Last Year in Alabama

- 2.1 million loans

- Only 246,000 borrowers

- 50% extended loan 6+ times

- $116 million paid in fees alone

On the ballot, voters chose 36% APR

- South Dakota (2016)

- Montana (2010)

- Arizona (2008)

- Ohio (2008)

95 million people live in states without payday loans.

15 States and D.C. Cap Interest Rates to Prevent Predatory Lending.

Alabamians deserve better. It’s time to end

Alabama’s predatory lending problem.

New York & New Jersey

Prohibit payday lending through their criminal usury statutes, limiting loans to 25% and 30% APR, respectively.

Ohio

28% APR cap; voters in late 2008 soundly rejected an industry ballot initiative to restore 390% APR.

Pennsylvania

Prohibits check-cashing companies from issuing loans based on post-dated checks and caps APR to less than 30%

Arkansas

17% APR usury cap in state Constitution. In 2010 voters adopted a 17% annual rate cap for consumer credit under the state constitution. In 2011, the legislature repealed the Act that had authorized payday lending.